A Facebook user claims he’s found a simple trick to avoid credit card holds at gas pumps, but the technique has sparked debate over whether it works—or even if it’s legal. The 18-second video, which he posted on Sunday, has attracted more than 93,000 views and 5,000 likes, along with plenty of skeptical comments from viewers.

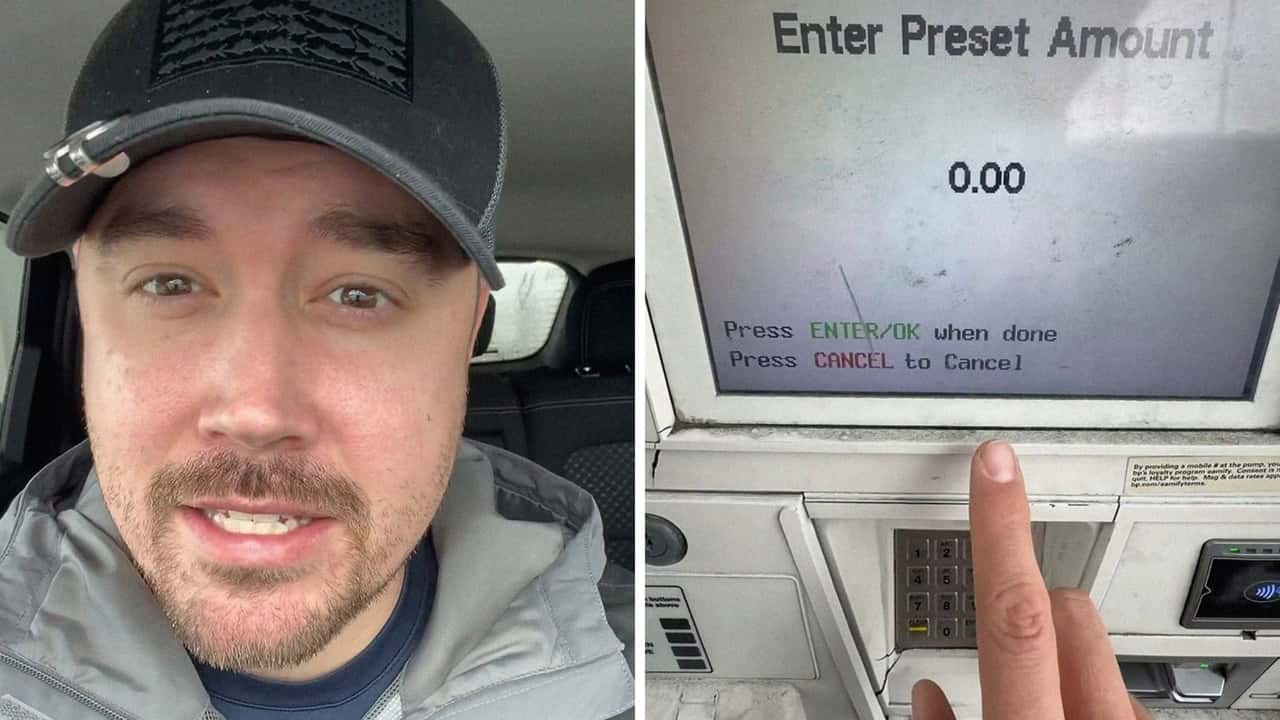

Ceith Griffith (@jgriffith34) posted the brief tutorial claiming motorists can preset a specific dollar amount at the pump without triggering the typical temporary hold or authorization that credit card companies place on accounts during fueling. His solution? Press the green “Enter” button on the pump before inserting your card.

“Before getting gas at any gas station, I’m going to show you how to keep your card from getting any kind of charge or any kind of hold on your money,” Griffith says in the video. “This will work at almost every gas station.”

The video then shows him demonstrating the technique at what appears to be a gas pump, pressing the enter button before proceeding. “Press enter, and now you can preset the amount you want to put in your car without any hold or any kind of charge,” he explains.

Understanding Credit Card Holds at Gas Pumps

Credit card holds at gas stations are a standard industry practice designed to ensure payment for fuel purchases. When you insert a credit or debit card at a pump, the station typically places a temporary authorization hold on your account—often ranging from $50 to $150, though Visa and Mastercard now allow holds up to $175 for EMV chip transactions—to guarantee they’ll receive payment for whatever amount of gas you pump.

This hold can be particularly problematic for debit card users, as it temporarily reduces their available account balance until the actual purchase amount is processed, which can take anywhere from a few hours to several days. For customers with tight budgets or low account balances, these holds can cause overdraft fees or declined transactions for other purchases.

The gas station industry implemented these holds as a security measure, since they don’t know how much fuel a customer will actually purchase when they first insert their card. Once the transaction is complete, the hold should be replaced by the actual purchase amount, but the timing of this process varies by bank and card processor.

According to industry guidelines, card issuers determine how long the hold remains on your account, and financial institutions are required to release unused funds in a timely manner.

Community Response: Mixed Reviews

The comments section on Griffith’s video reveals a community divided over whether the technique actually works and is legitimate.

Some users expressed excitement about trying the method. “I’m trying this tomorrow,” wrote Alishia Robin, while Deborah Thrift commented, “Thank you.” Kelli Schumacher praised Griffith’s content overall: “Thank you so much for all your tips and tricks all the time. I appreciate it.”

However, several commenters raised concerns about the technique’s effectiveness and legality. “It really just depends on how the pump has been configured. Believe me it doesn’t work everywhere if it does at all,” warned Joanie Jennings.

Others questioned whether the method might be considered fraudulent. “Isn’t that stealing?” asked Robyn Wilkerson, while Peggy Lloyd Edison bluntly stated, “It’s called stealing.” Delta Goolsby added, “Don’t think this is legal.”

Technical Skepticism

Some commenters brought technical expertise to the discussion.

Justine Caler, who appeared knowledgeable about payment processing, answered another user’s question about what happens if you preset more than you actually pump. “When the merchant settles, the exact amount you pumped will post. So the pre-auth for the 40.00 will fall off, and the 32.00 will post,” she explained. This aligns with how gas station payment authorization works: the hold is temporary and gets replaced by the actual transaction amount during settlement.

However, others pointed out potential flaws in the logic. Yanni Giftakis noted, “It still becomes a ‘preset’ (or hold, or whatever), because you are not required to fill up to that $$ amount.”

Multiple users reported that the technique doesn’t work in their experience. “Doesn’t work,” stated Kent Anderson, while Kay Kidwiler noted, “Nope it doesn’t work in WV.”

Alternative Solutions

Several commenters suggested traditional alternatives to avoid holds.

“Or you can just go inside. That’s what I do,” wrote Mel Clyburn, referring to the practice of prepaying inside the station, which allows customers to specify an exact amount without triggering a hold. This method is widely recommended by financial institutions and consumer advocates as the most reliable way to avoid pre-authorization holds.

“Just pay cash,” suggested Nedra Abbey, though Amy Jo Martinson pointed out this isn’t always possible: “Not a possibility at Costco! Only cards.”

Industry Implications and Concerns

Tracy Christine expressed surprise that the technique wasn’t already widely known: “Shocked people didn’t already know this. Smh.” However, the mixed responses suggest that if such a workaround exists, it’s not universally applicable across different pump manufacturers or station configurations.

One commenter, Zbyněk Spin Bečvář, raised an entirely different concern: “Cameras will see your plate number, and police will come to get you,” suggesting potential legal consequences if the method is considered illegitimate.

The Reality of Pump Programming

Gas pump systems are complex pieces of equipment with sophisticated payment processing capabilities. Different manufacturers, software versions, and station configurations can result in varying behaviors when customers interact with the pumps in non-standard ways.

What might work at one station or with one pump model may not work at another, which could explain the conflicting reports from users about the technique’s effectiveness. Additionally, stations regularly update their software and can modify settings that might affect such workarounds.

Payment Processing Standards

The payment card industry has established standards for authorization holds specifically to protect both merchants and consumers. These holds ensure that funds are available for transactions while preventing overcharges. Visa and Mastercard set guidelines that allow merchants to use pre-authorization holds as a risk management tool, and any method that circumvents these established protections could potentially violate terms of service agreements or payment processing regulations.

Banks and credit card companies have specific protocols for handling gas station transactions, including the timing and amounts of authorization holds. The practice is recognized as legal and standard by consumer protection agencies, including the Consumer Financial Protection Bureau (CFPB). It is governed by rules set forth by card networks and regulated under federal guidelines such as the Electronic Fund Transfer Act. Attempting to bypass these systems could potentially trigger fraud detection algorithms or other security measures that card networks use to monitor merchant activity.

Griffith’s Facebook page features similar short videos offering various motoring tips and tricks, suggesting he positions himself as someone sharing helpful automotive advice with his followers.

Motor1 attempted to reach Ceith Griffith via Facebook direct message for additional comment about his technique and its effectiveness. We’ll be sure to update this if he responds.